28+ Borrowing ability calculator

It is this commitment that makes us the right choice when selecting your. Call us anytime 1300 617 277 or 0406 047 202.

Collateralized Mortgageobligation Advantages And Disadvantages

As a result and mainly due to unnecessary interests it increases their risk of getting into new debts loss of creditworthiness bankruptcy etc.

. Calculate Your Rate in 2 Mins Online. This calculator is designed to help you work out your borrowing power based on your current financial position. We have designed this calculator to give you an estimated mortgage size but also an indication of how likely it will be to get it.

Borrowing Power Calculator Enter your income details Joint Income Yes No Dependents 0 1 2 3 Net salary Net salary2 Other net income Enter your expense details Living expenses Car loan payment Other payments Total credit card limits Enter your loan details Interest Rate Loan Term View your results You can borrow up to 381000. This mortgage calculator will show how much you can afford. But if you have a good handle then the money that you borrow will work perfectly according to your personal needs.

For instance an 8 interest rate for borrowing 100 a year will obligate a person to pay 108 at year-end. It is advised that you consult your financial adviser before taking out a loan. Think about your cash flow.

Mortgage lenders in the UK. The calculation uses your Debt Servicing Ratio which is found by dividing your total monthly repayments by your total monthly income. Calculate your borrowing capacity using this borrowing capacity calculator from Ming Sun Real Estate.

Check out the webs best free mortgage calculator to save money on your home loan today. Calculate your borrowing capacity using this borrowing capacity calculator from Investment Real Estate. Get an estimate in 2 minutes.

Lets start with the basics Total gross annual household income Down payment Province or territory of residence Loans and other debts per month Credit cards and lines of credit total owing. Lower borrowing limits and shorter repayment terms than secured loans. Fill in the entry fields and click.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Capacitymeasures a borrowers ability to repay a loan using a ratio to compare their debt to income. Unbeatable Mortgage Rates for 2022.

It takes into account your preferred loan terms as well as the following variables that are relevant to your income and outgoing expenses. Calculate how much you can borrow to buy a new home. Cash flow indicates how much money you have.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Ad Best Home Loan Mortgage Rates. Calculate what you can afford and more.

For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000 for a mortgage. Most lending institutions will lend to a maximum ratio of 32 with a 2 loading on loan rates. The results from this calculator should be used as an indication only.

Compare Offers Apply. The results from this calculator should be used as an indication only. Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds.

Generally lend between 3 to 45 times an individuals annual income. Suppose for example that you were comparing your existing 30 year loan with a 70 mortgage to a 65 Adjustable Rate Mortgage for 15 years. The mortgage calculator will take this information and display a graph detailing the amount of interest you will pay to each potential lender.

You can borrow up to 327000 Monthly repayments 1826 Note. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Use our calculator to get an estimate on your price range that fits your budget along with mortgage details.

Ad Work with One of Our Specialists to Save You More Money Today. Email Our Team email protected Request a call back. Get Pre-Qualified in Seconds.

Interest rate is the amount charged by lenders to borrowers for the use of money expressed as a percentage of the principal or original amount borrowed. GC Mutual Bank Ltd may not provide loans with. Our calculator includes amoritization tables bi-weekly savings.

Results do not represent either quotes or pre-qualifications for a loan. The first step in buying a house is determining your budget. It can also be described alternatively as the cost to borrow money.

Results do not represent either quotes or pre-qualifications for a loan. No1 Place In Australia To Find The Perfect Property. At A1 Real Estate Solutions our aim is to provide the highest standard of customer service available.

Our easy to use mortgage calculator will help answer this burning question by estimating how much you might be able to borrow on your own using a single income or with someone else using your joint earning power. Using our borrowing power calculator is relatively straightforward. You can use the above calculator to estimate how much you can borrow based on your salary.

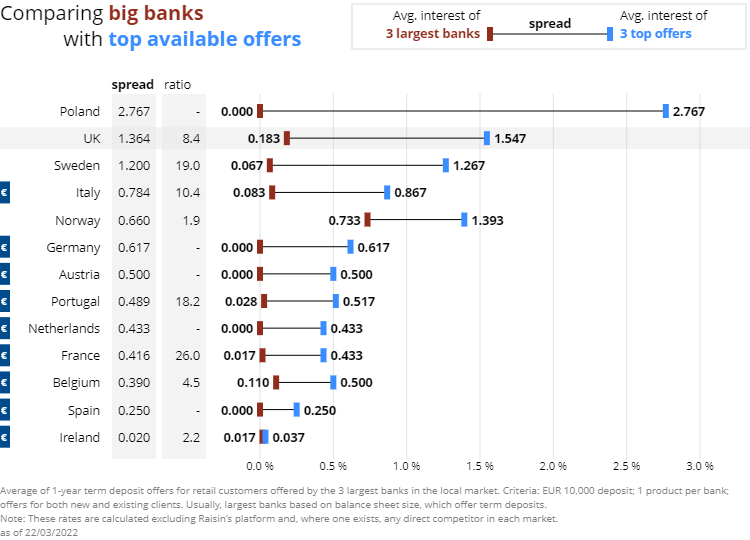

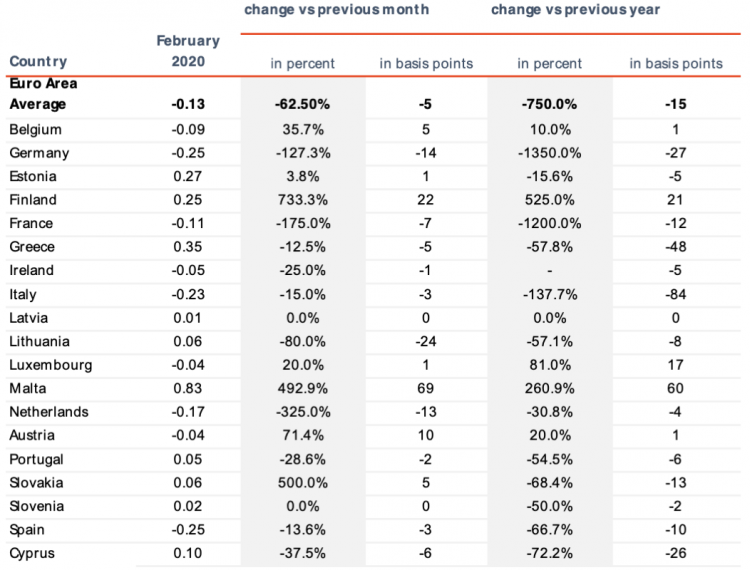

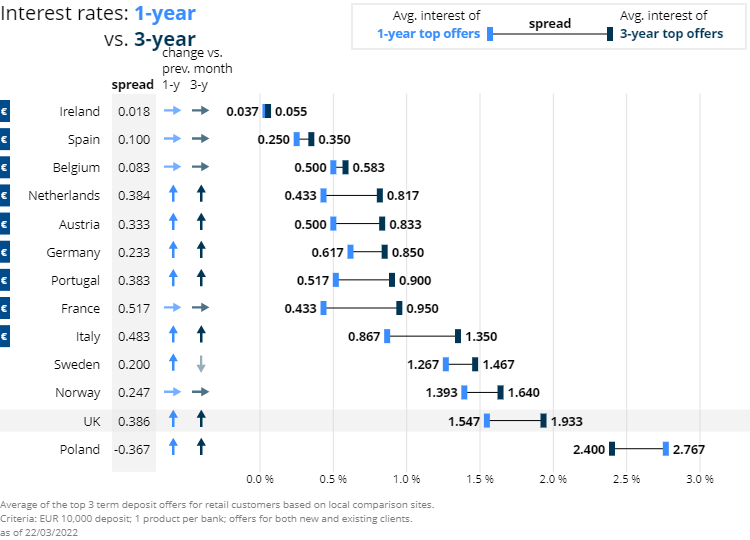

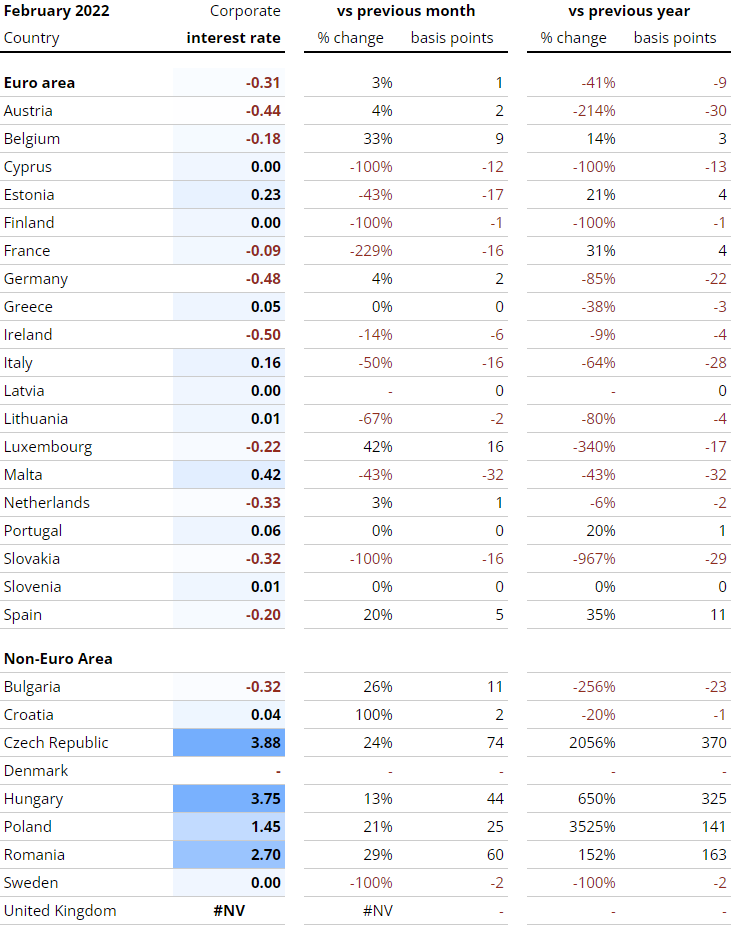

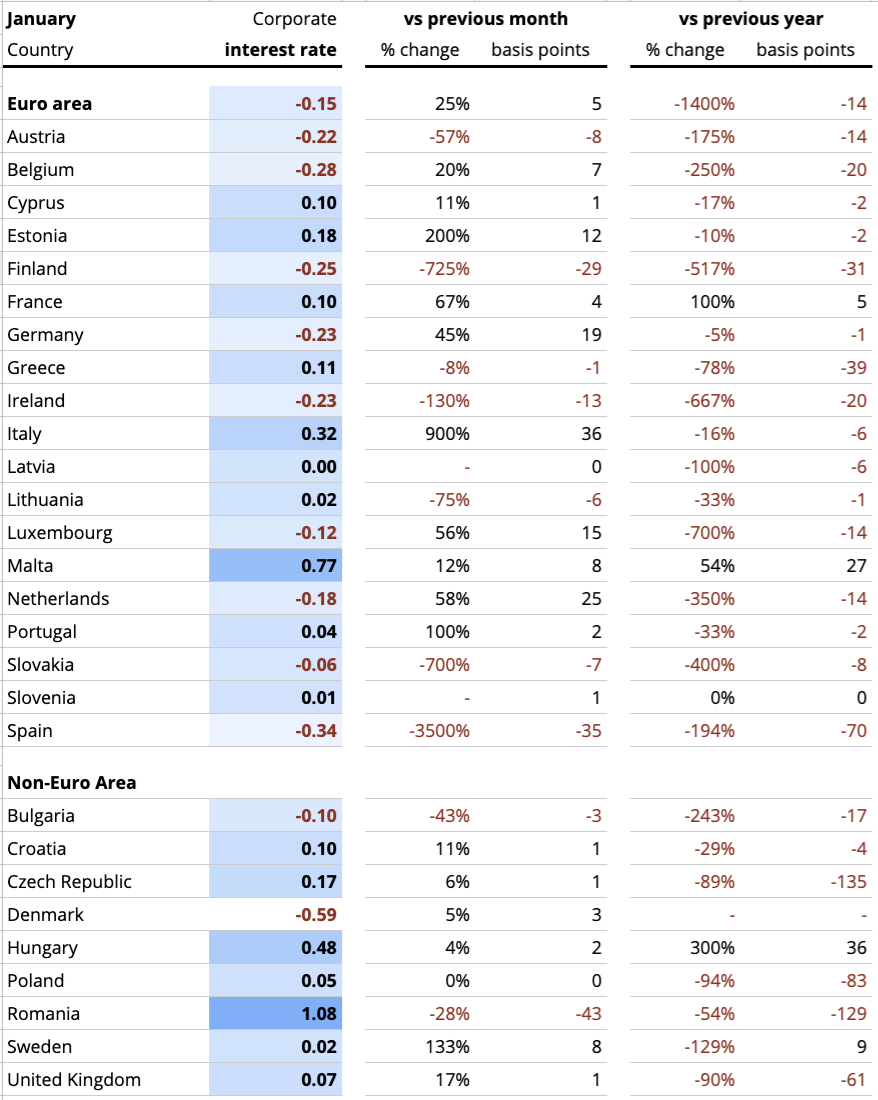

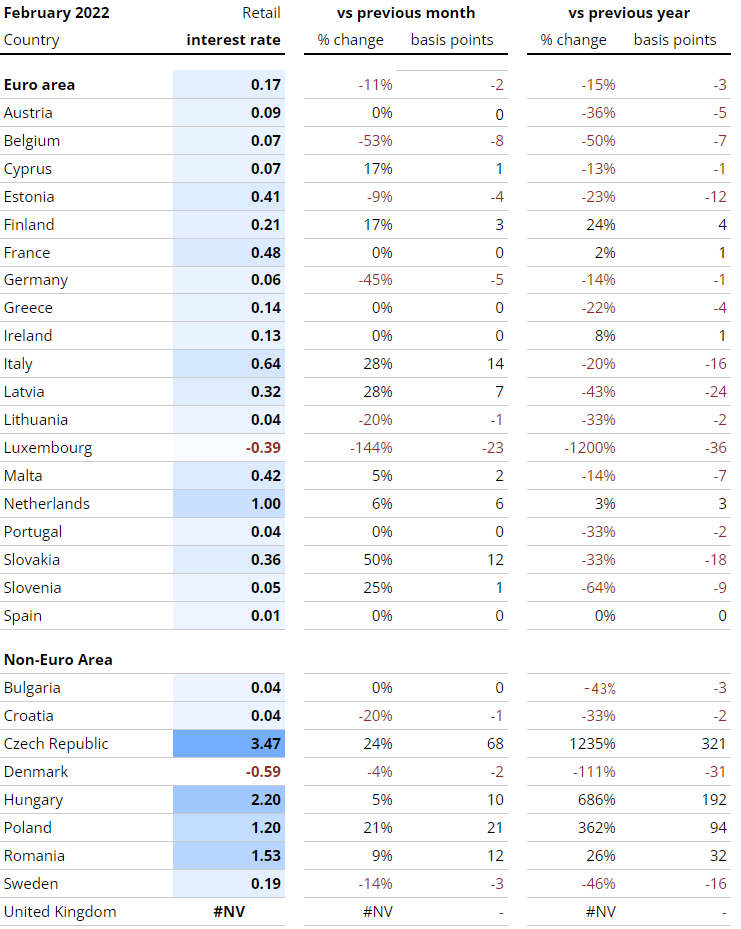

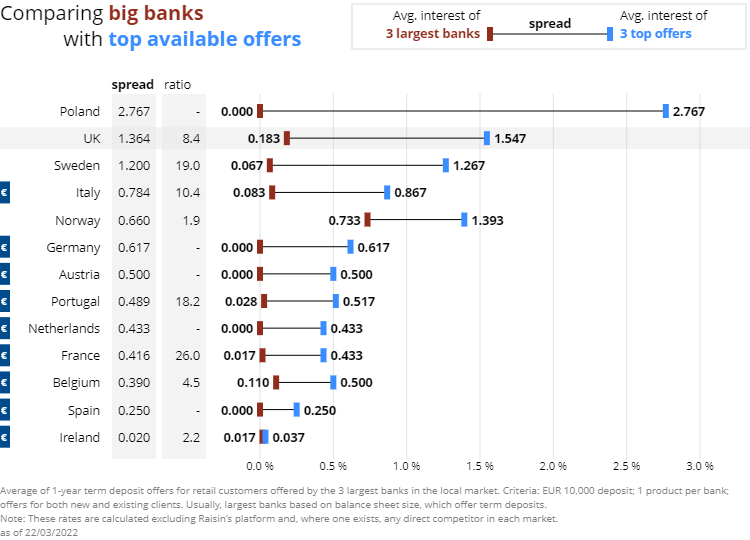

Interest Rates Explained By Raisin

Interest Rates Explained By Raisin

Interest Rates Explained By Raisin

Interest Rates Explained By Raisin

The New Student Loan Increase Basically A Stealth Income Tax On Graduates R Ukpersonalfinance

Should I Buy A Used Car In Finance Or Cash Quora

Credit Website Templates 56 Best Credits Page Web Themes

What Are The Pros And Cons Of Trading In Indian Markets Quora

Dave Ramsey Tips How You Can Actually Do The 7 Baby Steps

2

The New Student Loan Increase Basically A Stealth Income Tax On Graduates R Ukpersonalfinance

Collateralized Mortgageobligation Advantages And Disadvantages

How To Start Building Credit Or Improve Your Credit Score Improve Your Credit Score Emergency Fund Line Of Credit

2

Interest Rates Explained By Raisin

Interest Rates Explained By Raisin

2